2025 Luxury Watch Trend Report: Stabilisation, Sticker Shock, And A Second‑Hand Reset

Share

On the surface, 2025 started flat.

Swiss watch exports in the first half of the year were essentially unchanged at CHF 12.9 billion (-0.1% vs H1 2024). The Federation of the Swiss Watch Industry (FHS) noted 'strong contrasts' by market and a generally uncertain outlook.

That changed in August when the U.S. imposed new duties on Swiss imports: the tariff rate rose to 39 per cent, a massive blow to the industry given that the U.S. was the largest export market by value.

Industry commentary described the move as 'a heavy blow'. One report recorded a 16.8% share of Swiss watch exports to the U.S. in 2024 (≈CHF 4.4 billion) and warned of 'devastating' consequences if the tariffs persist.

The net effect: a year that began with cautious stability flipped into a more complicated second half.

Brands continued launching new models, but sales mix by region and channel shifted, pricing increased in the U.S., and the pre‑owned market’s slow slide finally stabilised.

New watch sales: price rises, metals pressure, and a store‑first shopper

Retail pricing increased across many portfolios, especially in the U.S., where brands sought to offset the tariff bite. Business Insider tracked a wave of U.S. retail increases and tied them to the diversification of demand toward the resale market.

Input costs played their part.

The Financial Times indicated a 40% surge in gold over the past year, forcing manufacturers to tweak assortments and experiment with alternative materials.

For Australia, where many buyers favour steel sports models and two‑tone classics, this metals squeeze translated into longer lead‑times for precious‑metal variants and firmer ticket prices in boutiques.

Channel behaviour also evolved. The Swiss watch industry’s 2025 study from Deloitte found that in‑store purchases again outpaced online retail, and the certified pre‑owned and independent resale ecosystem continued to grow.

That revival of bricks‑and‑mortar matters because physical distribution supports higher average selling prices and stronger attachment rates on straps and servicing.

US tariffs: the timeline, the impact, and the likely pass‑through

From a trade perspective, August was a key inflection point.

Reuters reported that Swiss luxury watchmakers’ shares dropped after the U.S. announced a 39% tariff on Swiss imports. The effect was immediate: the U.S. accounted for about 16.8% of Swiss watch exports in 2024.

On the ground, SwissInfo’s coverage of Geneva Watch Days 2025 captured the mood among executives who described the tariffs as 'a heavy blow'. Trade‑press analysis recorded a sharp one‑month drop in U.S.‑bound units in September.

How much of the tariff gets passed to the end consumer is brand‑specific, but the directional call is clear: list‑price increases, selective model prioritisation and margin compression. A Monochrome article forecasts that prices will rise between 10 % and 31 % for buyers once the U.S. measures are filtered through supply chains.

For collectors, there are two practical implications. First, U.S. retail arbitrage has narrowed or even flipped on some references, reducing the incentive to buy on American trips.

Second, brands with global pricing grids have a harder time keeping Australasian pricing insulated from big‑market shocks—even if Australia remains a bright spot.

Second‑hand watch sales: a floor is forming, blue chips lead

The most encouraging data point in 2025 is stabilisation in the pre‑owned market. After thirteen consecutive quarters of declines since mid‑2022, the platform WatchCharts and Morgan Stanley in Q2 reported a minuscule 0.3 % quarter‑on‑quarter drop, the slowest fall yet. WatchCharts added that while stabilisation is visible, macro risks remain.

Marketplace data also supports the drift toward normalcy. Chrono24’s H1 2025 report noted that Rolex maintained a dominant share of spend on the platform, and Gen Z buyers are reshaping tastes toward slimmer cases, colourful dials and a willingness to consider near‑mint over brand‑new if the price delta is meaningful.

Global pre‑owned market size estimates: SwissWatches Magazine aggregated research houses and sized the global pre‑owned market at US$22.84 billion in 2024, forecasting US$23.71 billion in 2025.

Simply put, liquidity has returned to the right names and the right conditions.

Rolex steel sports, modern Omega Speedmasters, Cartier Tanks/Santos, and core Patek complications are trading briskly when the full set, service history, and condition check out. Outside the core, price discovery remains ongoing, and buyers remain selective.

The release pipeline: fewer hype drops, more iterative craft

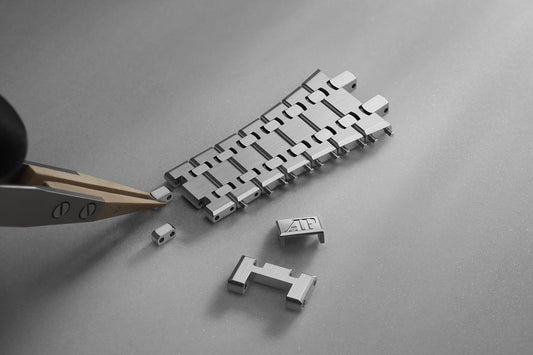

While the tariff and pricing headlines dominated, product strategy kept shifting toward iterative craft rather than stunt releases.

The FHS half‑year note warned of a widening gap between halo allocations and mainstream throughput. With gold becoming expensive and U.S. tariffs squeezing results, brands leaned into steel pillars, incremental movement updates and boutique‑centric colourways.

That means better odds of seeing desirable steel references at RRP, particularly when retailers can link them to servicing plans or local events. The flipside: slower flow of precious‑metal limited editions and tighter discounting policies on aged stock.

Outlook for 2026: what carries over, what fades

Three forces will shape early 2026.

First, the tariff path. If U.S. duties remain at current levels into Q1, expect another round of U.S. list‑price adjustments, continued allocation games and perhaps more divergence in global pricing.

Second, the pre‑owned floor. With Q2’s decline deceleration and blue‑chip names holding firm, a gentle bottom looks plausible, provided macro stays stable.

Third, materials and pricing. Elevated gold encourages deviation toward steel, bi‑colour or creative case materials as margin defence. If bullion cools, precious‑metal launches might re‑accelerate but most brands will defend the gains they took in 2024‑25.

What this means for buyers

If you plan to buy new, focus on authorised boutiques and act when allocations land. The price gap to U.S. retail has narrowed on many models; once warranty and local support are factored, local purchase is more compelling.

If you're shopping pre‑owned, the market is healthier than it was a year ago but still rewards patience. Go for full‑set, recent‑service pieces from top-quartile brands.

If you own gold references, be aware that input‑cost surges are in today’s retail tags. That can be good news for those who locked in prices earlier.

Bottom line

2025 was a year of two halves. A measured start gave way to trade‑policy shock, which distorted regional flows and pushed U.S. pricing higher.

New watch sales held up, where boutiques stayed busy and assortments leaned into proven pillars. Meanwhile, the second‑hand market finally found traction at the quality end exactly where long‑term collectors should feel most comfortable deploying capital in the year ahead.